Businesses

Market breadth turns very negative as 88 pc of stocks decline

New Delhi, March 13 (IANS) Deep cuts in PSU, power, infrastructure, metals, realty stocks have led to a sharp fall in the markets.

BSE Sensex plunged to 72,888.21 points, a fall of 779.75 points or 1.06 per cent. Among the Sensex losers, Powergrid is down more than 6 per cent, NTPC is down 6 per cent, Tata Steel is down more than 4 per cent.

Deep cuts are being seen across sectors. The PSU stocks index is down more than 5 per cent, utilities index is down more than 6 per cent, realty index is down more than 5 per cent, metals index is down more than 4 per cent.

This is adding to the misery in small caps which are down more than 4 per cent. Mid caps are down more than 3 per cent. SME IPO index is down more than 4 per cent.

The market breadth is very negative with 88 per cent of the stocks declining. As many as 975 stocks have hit the lower circuit indicating the extent of the selling pressure.

V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services, said in the near-term investors should focus on the sustained weakness in the broader market, particularly the small cap segment. The excessive valuations in these segments driven by the irrational exuberance of retail investors have been a concern for many months now. But it has taken the strong message from the regulator SEBI to trigger a correction in the Nifty Small cap index by 10 per cent from the February 8 peak.

–IANS

biz/san/uk

Businesses

June saw over 42 lakh new demat accounts amid bullish stock market

New Delhi, July 5 (IANS) As the Indian stock market keeps touching new highs amid a record bull run, over 42.4 lakh new demat accounts were opened in the month of June, the highest account opening rate since February.

In May, 36 lakh new demat accounts were opened, according to data from the Central Depository Service and National Securities Depository. The total demat accounts are now at more than 16.2 crore.

This is the fourth time when new demat openings crossed 40 lakh in a single month. The feat was earlier achieved in December 2023, January 2024 and February this year.

On Thursday, Sensex and Nifty made a new all-time high of 80,392 and 24,401 respectively. According to market experts, the return of FIIs to the domestic market and the expectation of a rate cut in September are supporting market sentiment.

After a run-up of 7 per cent in the last month, analysts expect the market to consolidate at a higher zone. “In the coming week, we expect stock and sector-specific action as the market starts taking cues from Q1FY25 earnings. On the macro front, investors will look out for inflation data that will be released by India, the US, and China,” said Siddhartha Khemka, Head of Retail Research, Motilal Oswal Financial Services.

–IANS

na/vd

Businesses

Women entrepreneurs get shot in the arm with more avenues for finance

Mumbai, July 5 (IANS) Financing Women Collaborative (FWC), an initiative of Women Entrepreneurship Platform (WEP) on Friday announced new collaborations to support women entrepreneurs by strengthening their access to finance at a workshop held here.

As part of the workshop, Anna Roy, Mission Director, WEP and Principal Economic Adviser, NITI Aayog, launched several initiatives.

Key highlights included the announcement of a partnership between MAVIM and MSC under FWC to improve access to finance through alternative credit rating mechanisms and work with banks to offer more tailored products for women entrepreneurs in Maharashtra.

An MoU exchange between WEP and GroW Network founded by AfD, SIDBI, and Shakti Sustainable Energy Foundation; launch of the “Seher” program by TU CIBIL and launch of the Shine program in partnership with CreditEnable to strengthen the credit readiness of women-led enterprises were other initiatives announced to benefit women entrepreneurs.

Additionally, SEWA Bank’s commitment to reaching out to more women entrepreneurs as a member of FWC was also announced.

The event included an engaging session exploring “Perspectives on encouraging banks to finance women beyond SHG groups” and a panel discussion titled “Accelerating women’s access to finance: Unlocking the potential of the women-led economy for achieving Vision 2047.”

The meeting was organised by WEP in partnership with TransUnion CIBIL (TU CIBIL) and MicroSave Consulting (MSC).

Key dignitaries included senior officials from NITI Aayog, RBI, the Ministry of Finance, the Ministry of MSME, SIDBI, public-sector banks, private-sector financial institutions, CSOs/NGOs, and women entrepreneurs who attended the workshop.

WEP, incubated in NITI Aayog in 2018 as an aggregator platform, transitioned into a public-private partnership in 2022. WEP aims to strengthen India’s women entrepreneurship ecosystem.

It provides a forum for all ecosystem stakeholders across government, business, philanthropy, and civil society to collaborate, converge, and align their initiatives towards scalable, sustainable and effective programs, enabling a larger impact for women entrepreneurs.

WEP has over 20 public and private sector partners collaborating to strengthen women entrepreneurs in India.

FWC, an initiative of WEP launched in September 2023, aims to enhance access to finance for women entrepreneurs in India. It is chaired by the Small Industries Development Bank of India (SIDBI) and co-chaired by TU CIBIL, with MSC as its secretariat.

FWC brings together the financial service sector and organisations working with women entrepreneurs to create a supportive financing ecosystem for women.

–IANS

sps/dan

Businesses

Govt rolls out electric bicycles to accelerate Lakhpati Didi scheme

New Delhi, July 5 (IANS) The Ministry of Rural Development on Friday signed an MoU with Convergence Energy Services Limited to empower rural women self-help groups by providing them with electric bicycles in order to give them access to green mobility.

The MoU was signed by Joint Secretary, of Rural Livelihoods from MoRD Smriti Sharan and MD & CEO, of Convergence Energy Services Limited Vishal Kapoor in the presence of Secretary, of Rural Development Shailesh Kumar Singh.

Shailesh Kumar Singh said that this partnership of Green Mobility will further support the economic and social empowerment of rural women and accelerate enabling of Lakhpati Didis in line with Prime Minister Narendra Modi’s vision.

Smriti Sharan stated that this partnership with EESL will prove to be a boon to the SHG women in rural entrepreneurship with green wheels.

Vishal Kapoor said through this intervention CESL is keen to support the government’s initiative of enabling three crore Lakhpati Didis in rural areas, reflecting its commitment towards women empowerment and national green objectives.

The project aims to build livelihood opportunities, independence and prosperity amongst SHG women, elevating their socio-economic standing. Additionally, the project intends to keep rural mobility congestion-free thereby contributing towards decarbonisation of the last-mile mobility space.

Convergence Energy Services Limited (CESL) is a subsidiary of state-owned Energy Efficiency Services Limited, a joint venture of public sector companies under the Ministry of Power. CESL is focused on energy solutions that lie at the confluence of renewable energy, electric mobility and climate change.

The electric bicycles are being provided under the Deendayal Antyodaya Yojana – National Rural Livelihoods Mission (DAY-NRLM) and is called the Sustainable Transport for Rural Entrepreneurs through Electric Bicycles” (STREE) for Self Help Group (SHG) Women.

STREE intends to empower the rural economy, especially the rural women by providing them access to green mobility through the introduction of electric bicycles.

DAY- NRLM is focusing on promoting SHG women-led enterprises with diversified opportunities in the manufacturing and service sectors covering the farm and non-farm domains.

Since its launch, DAY-NRLM has helped create the largest platform for social inclusion, access to financial services and women’s economic empowerment.

–IANS

sps/dan

Businesses

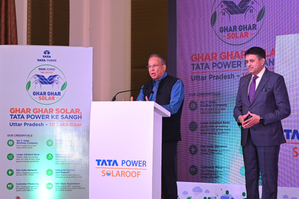

Tata Power launches rooftop solar initiative for homes in UP

New Delhi, July 5 (IANS) Tata Power Solar Systems Limited, has launched a rooftop solar initiative aimed at powering homes in Uttar Pradesh (UP) with clean energy.

Starting from Varanasi, the ambitious initiative promises substantial financial savings and environmental benefits for residents through state-of-the-art Rooftop Solar Solutions, the company said on Friday.

Consumers in the state can avail a maximum subsidy of up to Rs.1,08,000 on rooftop solar installation. This will comprise a Central government subsidy of Rs 78000 for up to 3 kW and a maximum of Rs 30,000 (Rs 15,000 per kW) for up to 3kW by the State Govt., which will be over and above the Central government subsidy.

“Tata Power Solar’s commitment to quality and innovation ensures that this initiative will significantly boost the region’s energy availability and sustainability. With a robust channel partner network Tata Power is well-positioned to offer expedited rooftop solar connections to the residents of Varanasi and Uttar Pradesh,” the company said in a statement.

Tata Power said the initiative aligns with India’s national goal to achieve 40 GW of solar rooftop installations

Speaking at the launch ceremony in Varanasi, Praveer Sinha, CEO& MD, Tata Power, said: “Tata Power solar offers made-in-India, state-of-the-art solar panels ensuring superior performance and longevity on installation. Its bifacial panels also ensure that light is absorbed on both sides, guaranteeing higher efficiency in less space.”

Switching to solar energy offers tremendous economic advantages. A typical household installing a 3 kW solar rooftop with an initial investment of around INR 1.08 lakh (subsidy of INR 1.08 lakh can be claimed) can generate 12 units of electricity daily, translating to approximately 360 units per month.

With the average electricity tariff in Varanasi, this setup can save residents up to INR 27000 per year on their electricity bills, Tata Power said.

Net metering allows residents to earn credits for any excess electricity generated by their solar systems and fed back into the grid. This not only reduces their electricity bills further but also ensures that no generated power goes to waste, enhancing the overall financial benefits of switching to solar energy.

–IANS

sps/dan

Businesses

Budget likely to see cut in fiscal deficit target to 4.9-5 pc on higher revenue receipts: ICRA

New Delhi, July 5 (IANS) Credit rating agency ICRA estimates the Central government’s revenue receipts will witness an upward revision of Rs 1.2 lakh crore in the forthcoming Revised Budget for 2024-25 over the Interim Budget Estimate, while pegging a relatively shallower increase in the revenue expenditure target, largely focused on the rural economy.

The rating agency expects the revenue receipts of the government to increase on the back of a higher RBI dividend and a rise in tax collections.

Consequently, the government is likely to set a fiscal deficit target at 4.9-5.0 per cent for FY2025, vis-a-vis the interim budget target of 5.1 per cent of GDP, without compromising the capital expenditure target of Rs. 11.1 lakh crore, ICRA said.

The rating agency is of the view that there is also a high likelihood of reducing the net market borrowings for FY2025 by Rs. 350-550 billion vis-à-vis the interim budget estimate of Rs 11.8 lakh crore, which would augur well for yields, along with the demand boost for government securities (G-secs) owing to their inclusion in the J.P. Morgan Government Bond Index.

–IANS

sps/dan

-

Video1 year ago

PM Modi Attacks Congress in Karnataka with “Kerala Story”

-

Cricket1 year ago

CSK players rejoice 5th IPL title with their families (Pics)

-

Politics1 year ago

Siddaramaiah & DK Shivakumar sworn in as Chief Minister & Deputy CM respectively

-

Entertainment1 year ago

Karan Deol weds his longtime Girlfriend Drisha Acharya (Pics)

-

Entertainment1 year ago

Urvashi Rautela dazzles on Cannes 2023 red carpet (Pics)

-

Entertainment1 year ago

Sunny Leone gets ready for Kennedy premiere in Cannes (Pics)

-

Entertainment1 year ago

Alia Bhatt looks crazy beautiful in Prabal Gurung creation at MET GALA 2023 (Pics)

-

Sports6 years ago

History Of Official FIFA WORLD CUP Match balls