Sci/tech

India's AI market to reach $17 bn by 2027, demand for talent to grow: Nasscom

New Delhi, Feb 20 (IANS) India’s artificial intelligence (AI) market is likely to grow at 25 per cent compound annual growth rate (CAGR) to reach $17 billion by 2027, with similar growth in AI investments, a Nasscom report said on Tuesday.

India’s AI market is growing with AI/ML capabilities, including GenAI, emerging as the top category of IT spend expected to be made by IT buyers in 2023, according to the report by Nasscom in partnership with market research firm BCG.

This growth is fueled by multiple factors which include increasing enterprise tech spending, India’s growing AI talent base and a significant increase in AI investments, said the report.

“Indian tech companies, with the advent of generative AI, are expanding their portfolios beyond traditional IT and business process management to include AI-driven analytics, intelligent automation, and personalised customer interactions,” said Debjani Ghosh, President, Nasscom.

“Accelerating this journey will require massive scale investment on AI skilling, investments in ethical and secure AI development practices and governance frameworks,” she added.

India today has the second highest installed talent base with 420,000 employees working in AI job functions.

The country also has the highest skills penetration with three times more AI skilled talent than other countries.

“The country ranks among the top 5 nations with a 14 times growth in individuals skilled with AI in the last seven years. As the investments in AI continues to increase, the demand for AI talent in India is also expected to grow at 15 per cent CAGR till 2027,” said the report.

Recognising the importance of human capital in the AI journey, leading firms have invested heavily in upskilling and reskilling their workforce in AI and related technologies, with some organizations allocating $1 billion over the next three years dedicated to upskilling.

“Indian companies are starting to keep pace with the growth of AI and the tech sector is creating future-ready organizations with dynamic and evolving Centers of Excellence driving the AI agenda,” said Rajiv Gupta, MD and Senior Partner, BCG.

–IANS

na/vd

Sci/tech

Low rainfall & high CO2 can replace India's biodiversity hotspots: Study

New Delhi, July 3 (IANS) Even as greenhouse gasses are increasing unprecedentedly, it can decrease rainfall in the equatorial region as well as affect India’s biodiversity hotspots, according to a new study on Wednesday.

The study showed that it will potentially replace India’s biodiversity hotspots consisting of evergreen forests in the Western Ghats, northeast India, and the Andamans with deciduous forests.

For the study researchers from Birbal Sahni Institute of Palaeosciences (BSIP), an autonomous institute of the Department of Science and Technology, used fossil pollen and carbon isotope data from the Eocene Thermal Maximum 2 (ETM-2), also known as H-1 or Elmo.

It is a period of global warming that occurred around 54 million years ago.

In addition to global warming, during this period the Indian plate also lingered near the equator during its journey from the southern to northern hemisphere.

“This makes the Indian plate a perfect natural laboratory that offers a peculiar opportunity to understand the vegetation-climate relationship near the equator during the ETM-2,” the researchers said.

Based on the availability of fossils from ETM2, the team selected the Panandhro Lignite Mine of Kutch in Gujarat and collected fossil pollen from there.

Their findings, published in the journal Geoscience Frontiers, found that when atmospheric carbon dioxide (CO2) concentration was more than 1000 parts per million by volume (ppmv) near the palaeo-equator, the rainfall decreased significantly. It led to the expansion of deciduous forests.

The study also raises important questions about the survival of equatorial/ tropical rainforests and biodiversity hotspots under increased carbon emissions. It can also help understand the relationship between CO2 and hydrological cycle and aid in the future conservation of biodiversity hotspots.

–IANS

rvt/pgh

Sci/tech

JNCASR team propose a new measure of flexibility for crystals

New Delhi, July 3 (IANS) Researchers at the Jawaharlal Nehru Centre for Advanced Scientific Research, (JNCASR), an autonomous institution under the Department of Science & Technology, have introduced a novel quantitative measure of mechanical flexibility for crystals.

The measure can be used to screen materials databases to identify next-generation flexible materials, said the team.

They carried out an in-depth analysis of the mechanisms underlying the flexibility of crystals of Metal-organic frameworks (MOFs) — a large class of crystalline materials that possess the remarkable ability to absorb gasses, such as carbon dioxide, and store them as well as act as filters for crude oil purification.

The team attributed the flexibility to large structural rearrangements associated with soft and hard vibrations within a crystal that strongly couple to strain fields.

The analysis opens doors to innovative materials with diverse applications in various industries, said the researchers.

MOFs derive their ability from the presence of nanopores, enhancing their surface areas that, in turn, make them adept at absorbing and storing gases. However, limited stability and mechanical weakness have hindered their broader applications, which was addressed by the new measure.

The new findings, published in the journal Physical Review B, present groundbreaking insights into the origin of mechanical flexibility. Flexibility in crystals has, historically, been assessed in terms of a parameter called elastic modulus — a measure of a material’s resistance to strain-induced deformation, but, on the contrary, the study “proposes a unique theoretical measure based on the fractional release of elastic stress or strain energy through internal structural rearrangements under symmetry constraints”.

Using theoretical calculations, the team examined the flexibility of four different systems with varying elastic stiffness and chemistries. The results showed that “flexibility arises from large structural rearrangements associated with soft and hard vibrations within a crystal that strongly couples to strain fields”.

The newfound measure of flexibility is also poised to revolutionise materials science, especially in the context of MOFs. “This theoretical framework enables the screening of thousands of materials in databases, providing a cost-effective and efficient way to identify potential candidates for experimental testing. The design of ultra-flexible crystals becomes more achievable, offering a practical solution to the challenges posed by traditional experimental methods,” said Professor Umesh V. Waghmare from the Theoretical Sciences Unit at JNCASR.

The potential applications of this research extend beyond the realm of physics, opening doors to innovative materials with diverse applications in various industries, the team said.

–IANS

rvt/vd

Sci/tech

247 mn Indian 'entrepreneurial households' to drive $95 trillion in transaction value by 2043

New Delhi, July 3 (IANS) India now has 247 million “entrepreneurial households” responsible for a whopping $8.8 trillion in transaction value for the fiscal year 2023, and expected to grow to $95.2 trillion by 2043 with an annual growth rate of 12.7 per cent, a report showed on Wednesday.

These “entrepreneurial households” will be key players in India’s next economic wave.

According to the report by Enmasse, Praxis Global Alliance, and Elevar Equity, the “entrepreneurial households” generate multiple income streams and use them along with borrowed funds to engage in high-value transactions involving important goods and services and business investments.

The report introduced a new term, ‘Core Transaction Value (CTV)’, which measures the total economic activity of these households, including all their earnings, borrowings, and spending.

“Given that we were taking a fresh approach to market sizing that felt almost impossible to begin — putting the customer segment first and not focusing on a sector or a product – we felt it is useful to provide additional visibility into our analysis and estimates, with triangulations from multiple sources,” said Madhur Singhal, Managing Partner and CEO, Praxis Global Alliance.

“Brands targeting these households have seen high returns on investment, comparable to the top companies listed in the Nifty50 stock index,” the findings showed.

The report underscored the importance of these households in driving future economic growth and prosperity in India.

“For entrepreneurs and investors, this presents a unique opportunity to innovate and invest in this rapidly growing market, potentially reaping substantial returns,” it added.

The “entrepreneurial households” are characterised by their savvy allocation of cash towards consumption and investments, which is indicative of their economic vitality, more than traditional income measures.

–IANS

na/vd

Sci/tech

India now has over 300 Family Offices from 45 in 2018 with smaller cities in focus: Report

New Delhi, July 3 (IANS) Driven by robust economic growth in India, the country now has over 300 Family Offices as against 45 in 2018 who are catalysing the creation of jobs with an emphasis on responsible investing, a report showed on Wednesday.

Their number is set to rise exponentially, with promoters building impressive businesses in tier 2 and 3 cities, said the PwC India’s latest report.

The Indian economy is on a roll and contributing to its expansion are family businesses, both large conglomerates and small-to-medium-sized enterprises, spanning sectors such as manufacturing, retail, real estate, healthcare and finance and accounting for 60–70 per cent of the country’s GDP.

“Such Family Offices have catalysed the creation of jobs, entrepreneurship and a culture of self-reliance in the country, unlike those that have gone south owing to a lack of adaptability, succession planning, innovation, and effective governance,” said the report.

Family Offices have also evolved into holistic service providers, championing ESG and technology for sustainable wealth.

“Over recent years, Family Offices have secured an integral spot in India’s financial ecosystem, offering specialised services tailored to the unique needs of high-net-worth individuals and business families,” said Falguni Shah, Partner and Leader, Entrepreneurial and Private Business, PwC India.

Amid these evolving trends, Family Offices also face several challenges. Building trust within family members and the family office is crucial but complex due to varying mindsets and interests.

“Family Offices in India are transforming wealth management by embracing technology, global diversification, and ESG principles. Their evolution from wealth preservation to impactful investing is crucial for sustainable growth and positive societal impact,” said Jayant Kumaar, Partner, Deals and Family Office Leader, PwC India.

–IANS

na/svn

Sci/tech

Indian startups raised nearly $7 billion in first half of 2024

New Delhi, July 3 (IANS) Indian startups have raised nearly $7 billion in funding during the first half (H1) of 2024, more than the $5.92 billion raised in H1 2023.

However, the figures are still far less than $20 billion in H1 2022, according to data compiled by TheKredible.

The $7 billion funding included 182 growth or late-stage deals worth $5.4 billion and 404 early-stage deals worth $1.54 billion. About 99 were undisclosed deals, reports Entrackr.

During H1, Indian startups produced a couple of unicorns — Perfios and Krutrim SI Designs. Last year, only two startups managed to cross the unicorn valuation while 2022 and 2021 witnessed the emergence of 26 and 44 unicorns, respectively.

When it comes to month-on-month trends, June witnessed nearly $2 billion in funding which is more than double the average of $1 billion monthly funding until May this year, the report mentioned.

Late-stage companies such as Zepto, Flipkart, PharmEasy and Lenskart topped with $665 million, $350 million, $216 million, and $200 million funding, respectively.

Moreover, H1 2024 saw 55 mergers and acquisitions, which is lower when compared to 2023. The year 2021 witnessed over 250 mergers and acquisitions which dropped to 204 in 2022 and further reduced to 145 in 2023.

Segment-wise, e-commerce topped the list with 124 startups raising more than $1.87 billion. Fintech, healthtech, SaaS and EV startups were next on the list. Amount-wise, EV startups secured more funding than SaaS and healthtech. Agritech, foodtech, edtech and proptech saw a decline in funding during H1 2024.

–IANS

shs/vd

-

Video1 year ago

PM Modi Attacks Congress in Karnataka with “Kerala Story”

-

Cricket1 year ago

CSK players rejoice 5th IPL title with their families (Pics)

-

Politics1 year ago

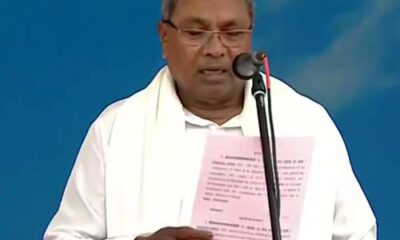

Siddaramaiah & DK Shivakumar sworn in as Chief Minister & Deputy CM respectively

-

Entertainment1 year ago

Karan Deol weds his longtime Girlfriend Drisha Acharya (Pics)

-

Entertainment1 year ago

Urvashi Rautela dazzles on Cannes 2023 red carpet (Pics)

-

Entertainment1 year ago

Sunny Leone gets ready for Kennedy premiere in Cannes (Pics)

-

Entertainment1 year ago

Alia Bhatt looks crazy beautiful in Prabal Gurung creation at MET GALA 2023 (Pics)

-

Cricket1 year ago

Sakshi & Ziva Dhoni enjoy their time during CSK VS MI match