Sci/tech

Happiest Minds acquires Noida-based PureSoftware Technologies for Rs 779 crore

New Delhi, April 25 (IANS) Leading IT company Happiest Minds Technologies on Thursday said it has acquired Noida-based PureSoftware Technologies for $94.5 million (Rs 779 crore).

Through this acquisition, Happiest Minds said it has strengthened its domain capabilities in banking, financial services, insurance (BFSI) and healthcare and life sciences verticals.

PureSoftware, with its 1,200-strong workforce, will augment the capabilities and services offerings to Happiest Minds’ product and digital engineering services (PDES) business unit.

“Our Mission of ‘Happiest People. Happiest Customers’ and PureSoftware’s ‘Customer Delight by Creating Employee Delight’ harmonises our shared vision of driving happiness for people and customers,” said Ashok Soota, Executive Chairman, Happiest Minds.

In addition to augmenting its presence in the US, the UK and India, Happiest Minds will also get a near-shore presence in Mexico and offices in Singapore, Malaysia, and Africa.

PureSoftware reported revenues of $43 million (Rs 351 crore) for fiscal 2024.

“As a part of Happiest Minds family, we will be able to deliver even greater value to our stakeholders including customers, employees and partners,” said Anil Baid, Chairman & Chief Strategy Officer, PureSoftware.

The acquisition involves upfront payment of Rs 635 crore and deferred of upto Rs 144 crore payable at the end of FY25, on achievement of set performance targets.

–IANS

na/

Sci/tech

EU accepts Apple's offer to open up contactless payments

London, July 11 (IANS) The European Union (EU) on Thursday accepted commitments offered by Apple over how it operates Apple Pay to end a long-running competition investigation.

“The Commission has decided to accept commitments offered by Apple. These commitments address our preliminary concerns that Apple may have illegally restricted competition for mobile wallets on iPhones,” said Commission EVP Margrethe Vestager, who heads up the EU’s competition division.

“Apple has until July 25 to implement their commitments. As of this date, developers will be able to offer a mobile wallet on the iPhone with the same ‘tap and go’ experience that so far has been reserved for Apple Pay,” she added.

In 2020, the EU formally launched an antitrust investigation related to Apple Pay. The investigation looked at the terms and conditions Apple sets for integrating Apple Pay in apps and websites and concerns around the ‘tap and go’ technology and alleged refusals of accessing Apple Pay.

In 2022, the Commission found that Apple Pay could restrict competition as it was the only option for iPhone users.

“Our preliminary finding was therefore that Apple abused its dominant position by refusing to supply the NFC technology to competing mobile wallet developers,” the Commission mentioned.

In Europe, the most widely available technology for mobile payments in stores is called ‘Near Field Communication’ (NFC). This technology enables wireless communication between a mobile phone and a store’s payments terminal. It allows users to ‘tap and go’ with their mobile phone.

NFC technology was not developed by Apple. It is a standardised technology and made available for free.

Apple refused to give access to the NFC technology on the iPhone to rival wallet developers and instead reserved the use of the technology on the iPhone to its own mobile wallet solution, the Commission said.

Now, the Commission has ended the investigation and mentioned that iPhone users will be able to use their preferred mobile wallet for payments in stores.

“They will be able to do so while enjoying all the iPhone’s functionalities, including tap-and-go, Double-Click and FaceID,” it added.

–IANS

shs/dan

Sci/tech

India pips China to become real estate capital of Asia: Hurun report

New Delhi, July 11 (IANS) With real estate companies worth $36 billion in 2024, India is accelerating to become the real estate capital of Asia, pushing away China in terms of growth rate, a new report said on Thursday.

China’s real estate market is facing significant headwinds due to government clampdowns and demand slowdown.

While in India, with the middle class projected to reach 547 million by 2030, residential sales are expected to grow 10-12 per cent in FY2024-25, according to the ‘2024 GROHE-Hurun India Real Estate 100’ report.

“Rising foreign investments of around $4 billion yearly are further catalysing growth,” said Anas Rahman Junaid, Founder and Chief Researcher, Hurun India.

Sixty of the top 100 companies operate beyond their core state headquarters, indicating a significant trend towards national brand building in the real estate sector.

“Notably, six companies on the list have an international presence, demonstrating the global ambitions of Indian real estate companies. With the strength of the Indian diaspora, Indian real estate companies are well-positioned to expand internationally, a trend we expect to see grow in the coming years,” Junaid emphasised.

DLF emerged as the top real estate company in the list, with a valuation of Rs 2,02,140 crore, followed by Macrotech Developers with a valuation of Rs 1,36,730 crore and Indian Hotels Company at third spot with a Rs 79,150 crore valuation.

Among the top 10 companies, 60 per cent are headquartered in Mumbai, while two are based in Bengaluru and one each in Gurugram and Ahmedabad.

“The list showcases that entrepreneurs hailing from tier 2 cities are forging some of the most impactful real estate enterprises in the nation. Five per cent of the entrants in 2024 GROHE-Hurun India Real Estate 100 hail from tier 2 cities. This highlights the fact that geographic boundaries no longer limit the rise of influential real estate players in India,” informed Junaid.

India is projected to add 200,000 km of national highways by 2037, fostering the growth of micro cities and further value addition by India’s real estate sector, he added.

–IANS

na/uk

Sci/tech

96 pc of Indian SMBs may consider paying cybercriminals: Report

New Delhi, July 11 (IANS) About 96 per cent of Indian small-and-medium businesses (SMBs) might consider paying cybercriminals in the event of ransomware extortion, a new report said on Thursday.

According to cybersecurity company ESET, about 88 per cent of Indian SMBs experienced breach attempts or incidents in the past 12 months.

“Our report reveals that although SMBs are confident in their security measures and IT expertise, the majority still faced cybersecurity incidents over the past year,” said Parvinder Walia, President of Asia Pacific & Japan at ESET.

The report, which surveyed over 1,400 IT professionals, found that ransomware, web-based attacks, and phishing emails emerged as the top concerns of Indian SMBs.

India and New Zealand experienced the highest number of security breaches or incidents, despite expressing the highest levels of confidence in their security systems.

Moreover, the report mentioned that 63 per cent anticipated a rise in cybersecurity spending over the next 12 months, with 48 per cent of these firms expecting to do so by more than 80 per cent.

SMBs in India are also planning significant cybersecurity enhancements over the next 12 months. About 38 per cent aim to deploy Endpoint Detection and Response (EDR), Extended Detection and Response (XDR), or Managed Detection and Response (MDR) solutions. Additionally, 33 per cent plan to incorporate cloud-based sandboxing, 36 per cent will implement full-disk encryption, and 40 per cent will focus on vulnerability and patch management, the report said.

–IANS

shs/vd

Sci/tech

Banking sector witnessing a decade-high performance: RBI

New Delhi, July 11 (IANS) As India aims to become the world’s third largest economy soon, the banking sector is undergoing a decade-high performance in financial metrics, according to Swaminathan J, Deputy Governor of the Reserve Bank of India (RBI).

According to him, the central bank is busy improving the auditing process to safeguard the integrity and stability of financial institutions.

“Auditors and chief financial officers are key pillars of financial integrity and governance in our banking system. Auditors must apply due rigor in their audit processes to mitigate any potential for divergence, under-provisioning, or non-compliance with statutory and regulatory requirements, said Swaminathan at a conference in Mumbai.

Swaminathan said that the RBI has introduced structured meetings between supervisory teams and auditors, exception reporting, and streamlined auditor appointment processes.

He also cautioned Chief Financial Officers against the evergreening of loans and fraudulent transactions through certain bank accounts with large corpus amounts without valid reasons.

Swaminathan also emphasised the importance of collaboration between stakeholders in the banking financial system.

Meanwhile, India’s Financial Inclusion Index (FI-Index) for the financial year ended March 31, 2024, improved to 64.2 compared to 60.1 in March 2023, with growth witnessed across all sub-indices, the RBI announced.

The improvement in the FI-Index reflects a deepening of financial inclusion across the country.

There has been a renewed national focus on financial inclusion, promoting financial education and literacy and making credit available to productive sectors of the economy including the rural and Micro, Small and Medium Enterprises (MSME) sector which has led to the improvement in the FI-Index.

–IANS

na/svn

Sci/tech

Homegrown Indkal to manufacture Acer-branded smartphones in India

New Delhi, July 11 (IANS) Homegrown Indkal Technologies on Thursday announced its foray into the smartphone market under a trademark licencing agreement with the Taiwanese electronics company Acer, in which it will design, manufacture and distribute smartphones under the Acer brand in India.

“Our customers will experience exceptionally well-designed smartphones with high-end processors, top-notch camera technology and a host of premium features across the range,” Anand Dubey, CEO of Indkal Technologies, said in a statement.

Indkal Technologies will launch a wide range of smartphone models under the Acer brand in mid-2024, expecting to quickly build strong momentum and a significant market share.

“We are excited that Indkal Technologies will further this mission in India by providing a wide range of smartphones under the Acer brand that expand end-user choices and enrich their experience in the Indian market,” said Jade Zhou, VP of Global Strategic Alliances at Acer Incorporated.

This venture signifies the entry of a major computing brand into the Indian smartphone market, highlighting the segment’s immense growth potential.

With a focus on smartphones priced between Rs 15,000 to Rs 50,000, this market will now see strong competition, the company said.

These devices will be available for purchase through both e-commerce platforms and offline retail stores across the country.

–IANS

shs/rad

-

Video1 year ago

PM Modi Attacks Congress in Karnataka with “Kerala Story”

-

Cricket1 year ago

CSK players rejoice 5th IPL title with their families (Pics)

-

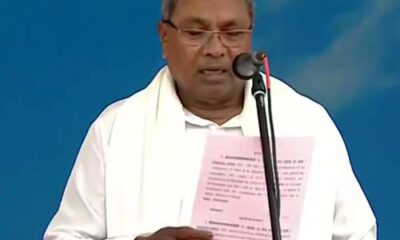

Politics1 year ago

Siddaramaiah & DK Shivakumar sworn in as Chief Minister & Deputy CM respectively

-

Entertainment1 year ago

Karan Deol weds his longtime Girlfriend Drisha Acharya (Pics)

-

Entertainment1 year ago

Urvashi Rautela dazzles on Cannes 2023 red carpet (Pics)

-

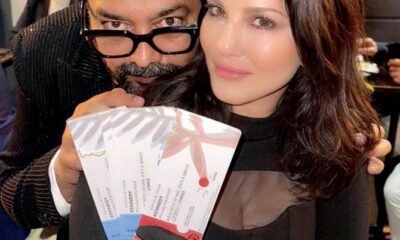

Entertainment1 year ago

Sunny Leone gets ready for Kennedy premiere in Cannes (Pics)

-

Entertainment1 year ago

Alia Bhatt looks crazy beautiful in Prabal Gurung creation at MET GALA 2023 (Pics)

-

Cricket1 year ago

Sakshi & Ziva Dhoni enjoy their time during CSK VS MI match